The forgiveness feature of the Paycheck Protection Program (PPP) loan is by far its most attractive feature. Attractive as it is, the actual mechanics and calculations going into forgiveness are complex.

Inadvertently not following the provisions within the CARES Act covering forgiveness could expose you to being liable for repaying the loan rather than having it forgiven.

This post is meant to guide you through the PPP loan forgiveness requirements step by step to help improve your chances for having your PPP loan forgiven.

What Is the Paycheck Protection Program?

Keeping American workers employed and paid is the driving force behind the creation of the PPP loan. If you are one of the 3.87 million small businesses lucky enough to have been approved and funded for a PPP loan you are probably asking yourself right now, “What’s next?” Good question.

Basically, the clock starts counting down the day your loan closes, and the funds are deposited into your bank account. The loan is intended to cover eight weeks of expenses starting on the date your loan is funded.

These expenses being:

- Payroll costs

- Interest on mortgage loans that you had in place before February 15, 2020

- Rent payments for rental agreements in place before February 15, 2020

- Utility payments for service agreements in place before February 15, 2020

We’ll get into the details of these in a minute.

Sounds good, right? Hold on!

There are limitations to the amount that your loan can be forgiven.

You need to make sure you are spending at least 75% of the loan amount on payroll costs. And, if you reduce the number of employees and/or employee wages during the 8-week time period after you receive the loan, you may have your loan forgiveness amount reduced. Not good!

In order to obtain forgiveness, you will need to submit an application along with required documentation to your bank in order to be considered for forgiveness.

No documentation, no forgiveness. It’s that simple.

The forgiveness of the loan will be considered a cancellation of debt. And, as of this point in time, it will not be included in your gross income for tax purposes.

The Details of Paycheck Protection Program Loan Forgiveness

The devil may be in the details, but so is forgiveness. Let’s get into the details then.

The amount of your loan that may be forgiven is based upon the sum of the following costs you have incurred and payments you’ve made during the 8-week period following the date of your loan:

- Payroll costs. The same payroll costs that were used to calculate your loan amount. You will remember, these include employees’ salaries, wages, commissions, similar compensation, cash or other tips, vacation pay, group health care benefits, any retirement benefits, etc.

- Interest Payments. Interest on mortgage loan obligations that were in place prior to February 15, 2020. What types of mortgages are we talking about here? Real estate mortgages count. Equipment and business auto loans count too. Any loan that is collateralized by real or personal property.

- Rent Payments. Payments made on lease obligations for any lease agreement that was in place prior to February 15, 2020.

- Utility Payments. Payments for electricity, water, gas, telephone services, or internet services that were started before February 15, 2020.

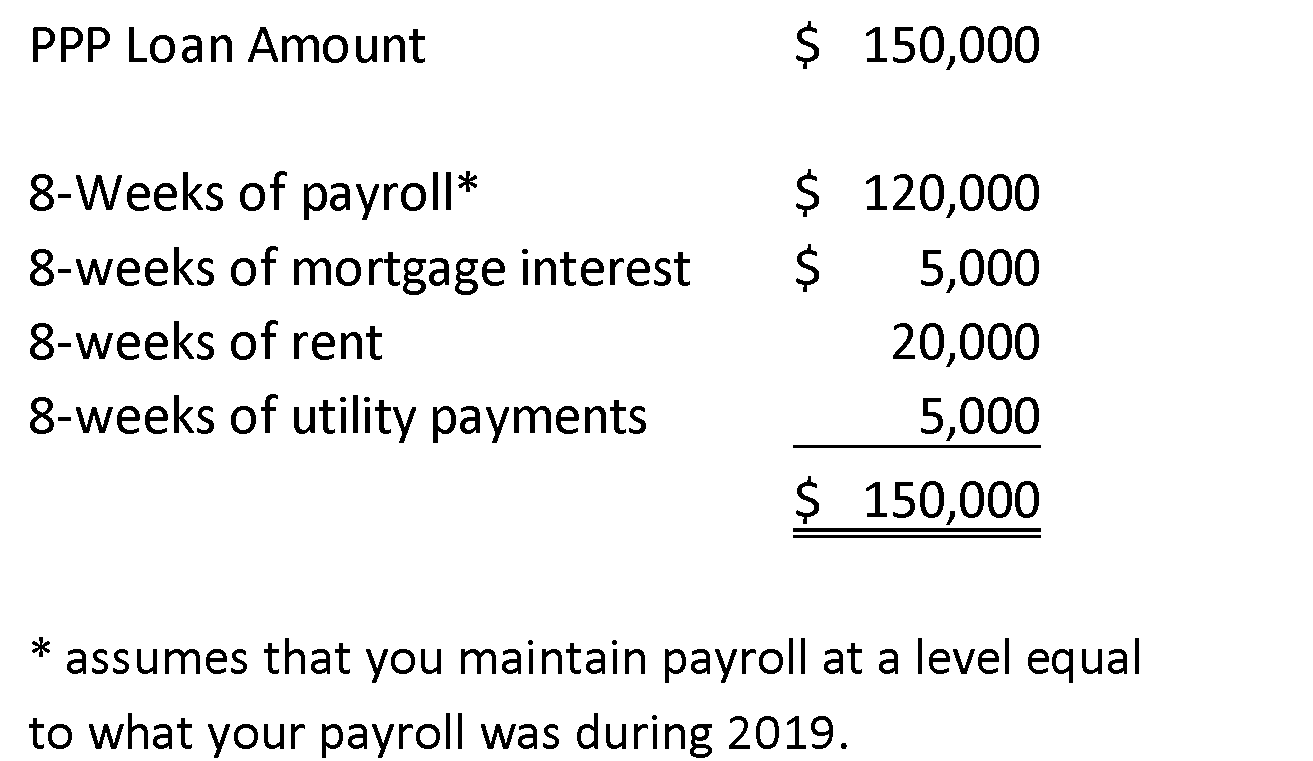

By way of an example, let’s assume you’ve received a PPP loan for $150,000, your average monthly payroll is about $60,000 and you’ve made the following payments during the 8-weeks following your loan, your forgiveness amount would look like this:

In this example, 100% of your loan amount would be forgiven, right? However, there are three hurdles that need to be overcome.

3 Causes of PPP Loan Reduction

There are three chances that our forgiveness amount may be reduced.

#1) 75% of Forgiveness for Payroll

Our first hurdle is this, no more than 25% of the forgiveness amount can be related to non-payroll related costs. In the above example, we would be able to overcome this hurtle since only 20% of the forgiveness amount, or $30,000, relate to non-payroll related costs.

#2) Impact of Reduction in Headcount

The next hurdle we need to overcome is headcount. Again, keeping people employed is the purpose behind the PPP loan. If we reduce our headcount, as calculated in full-time equivalents (FTE’s), our potential forgiveness amount will be reduced proportionately.

A few words on the FTE calculation:

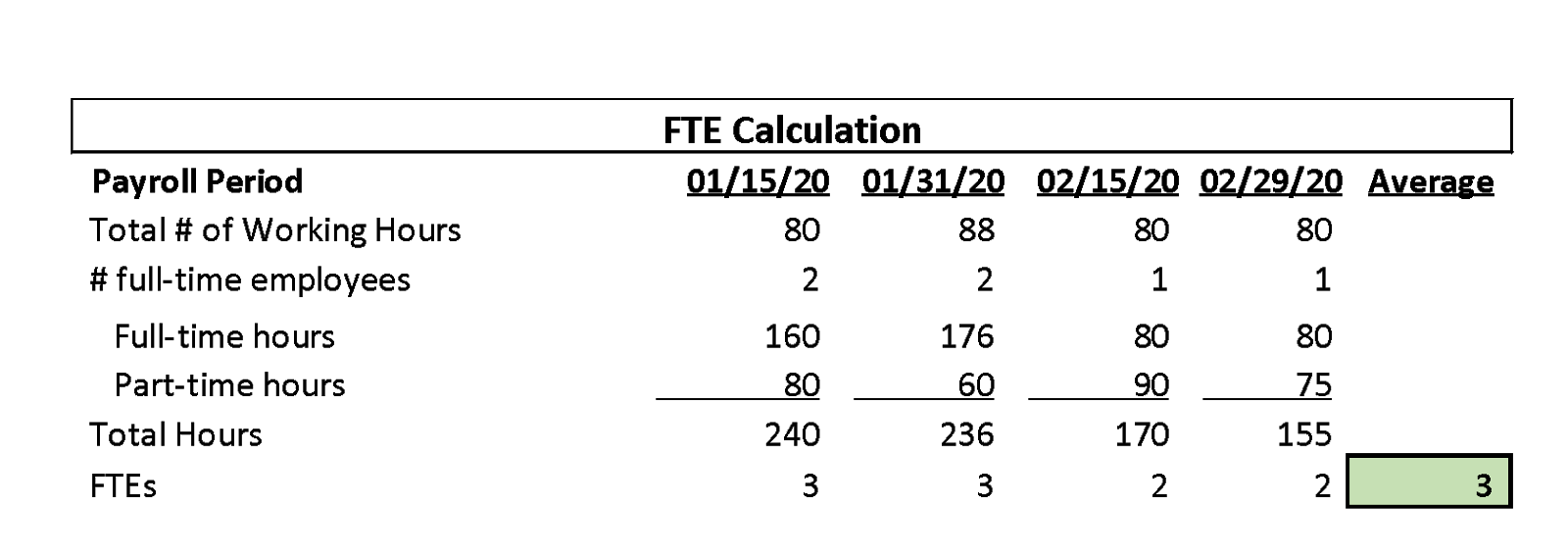

- You can calculate your base FTE count by using either the payroll periods from 02/15/2019 – 06/30/2019 or 01/01/2020 – 02/29/2020.

- Use the number of pay periods falling within the month to determine your FTE calculation. For example, if your payroll cycle is semi-monthly each month would have two pay periods, but if your payroll cycle is monthly January 2020 has five pay periods and February 2020 has four pay periods.

By way of example, let’s say you started 2020 with two full-time employees and two part-time employees that worked an average of four hours per day. In February, you moved one of your employees from full-time to part-time working four hours per day because of a decline in your business due to COVID-19. Your FTE calculation would look like this:

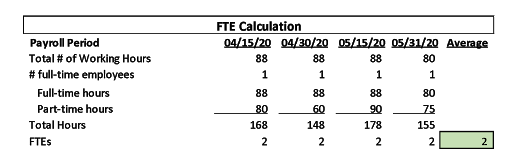

Let’s assume you received your PPP loan on April 14, 2020, and you kept your staffing levels the same as they were at the end of February 2020. Your FTE calculation would look like this:

In effect your FTEs declined by 66.67% (2/3rds). In turn, your loan forgiveness amount would be reduced from 100% to 66.67%. If you had a PPP loan in the amount of $20,000 the amount that may be forgiven would be reduced to $13,334.

#3) Impact of Reduction in Salaries and Wages

In addition to having your loan forgiveness reduced as a result of reducing the number of employees that you are paying, you can have your loan forgiveness further reduced if you decrease what you pay your employees by more than 25%.

For example, let’s assume maintained your headcount, but you reduced everyone’s pay by 30% in order to reduce costs as a result of the impact COVID-19 had on your business. If you did not restore the employee wages to what they were before COVID-19 once you received your PPP loan, your loan forgiveness would be reduced by 5% (30% – 25%).

If you rehire furloughed employees and/or restore your employee’s wages to what they were before COVID-19 by June 30, 2020, you may still be able to obtain 100% forgiveness of your PPP loan.

How to Request PPP Loan Forgiveness

In order to obtain forgiveness of your PPP loan, you will need to submit an application for forgiveness to your lender. The form and content of this application has yet to be developed or released by the SBA. As with the application process, it is best to work with your lender on the forgiveness process as well.

Expect to be required to provide the following documentation.

- Payroll records and tax filings to the IRS to support the amount of payroll payments made during your 8-week period.

- State income, payroll and unemployment insurance filings. This will support the state tax cost included in the payroll cost calculation.

- Cancelled checks, payment receipts, transcripts of accounts verifying payments made for mortgage interest, rent, and utility costs.

- Copies of contracts or agreements may also be needed in order to document that the agreements were in place prior to February 15, 2020.

In addition, a representative from the company will need to make certifications to the accuracy of the requested forgiveness amount as well as the documentation provided. Lenders are required to make a decision on forgiveness within 60 days of receipt of the application.

Ensure That Your PPP Loan Is Forgiven

The best way to ensure that your paycheck protection program loan is forgiven is by working with a professional who fully understands the process and requirements. One missed step could have you paying back a loan you thought would be forgiven, so make sure someone who understands the process is managing the process.

If you don’t have anyone on your team who feels confident managing the process, CFO2U is here to help. We’re working with clients to make sure they follow every PPP loan requirement so they can have their loan forgiven.

- 6 Expensive QuickBooks Mistakes You Might Be Making - January 29, 2024

- How to Make a Profit and Loss Statement & Analyze It for Insights - December 26, 2023

- Add These Important Tax Deadlines to Your 2024 Calendar - December 7, 2023